Understanding Multicurrency Accounting

In an increasingly globalized business environment, managing finances across multiple currencies is both an opportunity and a challenge. Companies expanding internationally encounter complexities related to exchange rates, currency fluctuations, and transparent reporting. The following provides the essential basics you need to know to understand multicurrency accounting.

What is Multicurrency Accounting?

Multi-currency accounting is a method used by businesses that operate in multiple countries or deal with customers and suppliers in different currencies.

With multicurrency accounting, companies conducting business internationally (e.g., eCommerce stores, importing/exporting businesses, companies with international subsidiaries, etc.) can manage, track, and record their transactions easily and accurately, while also remaining compliant with accounting regulations and principles. Multicurrency accounting helps companies simplify—and reduce the cost of—the entire process.

Key Concepts

The following key concepts are central to multicurrency accounting:

Base Currency vs. Transaction Currency vs. Reporting Currency

The base currency—also known as the functional currency or the domestic currency—is the default currency businesses use, and it is most often the currency of the country in which they are located.

The transaction currency is the currency used in a transaction. For example, if a company in the United States purchases a product from a Japanese company, the US company, which has a base currency of US dollars, will likely pay in Japanese yen. So, the Japanese yen would be the transaction currency.

In addition, in multinational companies the parent company and the subsidiaries often have different base currencies. In those cases, the subsidiary will prepare its financial statements in its base currency and then translate them to the reporting currency for consolidation at the parent company level. For example, a Canadian subsidiary of a US company will first prepare its financial statements in CAD and then translate them to USD for consolidation.

Foreign Currency Exchange Rates

Exchange rates are the rates at which currencies are valued when they’re exchanged from one to the other. These rates vary—hourly or daily—and are set by the global financial marketplace.

Foreign Currency Transactions

Foreign currency transactions are company transactions that occur in a currency other than the business’s base currency.

Challenges of Multicurrency Accounting

Multicurrency accounting is complex. Because exchange rates are constantly changing, companies must track them meticulously to make sure that currency conversions—and, thus, their gains and losses—are accurately reported.

They also have to effectively manage local and global reporting requirements, pay transaction fees, understand the performance of differing divisions that operate internationally, and generate reports using complex, multicurrency formulas.

And some companies attempt to do all of this manually.

Trying to accomplish these complicated tasks by hand is time-consuming and runs the risk of human error, which can lead to very expensive mistakes. Instead, companies should tackle multicurrency accounting with accounting technology designed to easily handle and simplify its complexities.

Understanding Multicurrency Accounting Systems

Simply put, a multicurrency accounting system is software that can handle multiple currencies from within a single solution. Such systems streamline multicurrency accounting, reduce the costs associated with it, and replace the threat of human error with the confidence of accurate, up-to-date data.

But not all multicurrency accounting systems are the same, and businesses should carefully research their options to select the software that best fits their operations.

Components to Look for in a Multicurrency Accounting System

The right multicurrency accounting system should possess—at a minimum—the following three critical features:

- Exchange Rate Tracking to keep up with rates as they constantly fluctuate.

- Currency Rate Type Management to handle different currency rate types, including floating rates (which change based on the foreign exchange market) and fixed rates (which are set to the value of another currency).

- Denominated Accounts to maintain account balances in two currencies: the company’s base currency and the currency in which transactions will be paid (also called the currency of denomination). Returning to the previous example of a US company purchasing from a Japanese company, these denominated accounts would maintain balances in US dollars (the base currency) and Japanese yen (the currency of denomination).

Benefits of Implementing a Multicurrency System

From simplifying multicurrency transactions and reducing the time, money, and risks associated with the multicurrency accounting process, a multicurrency system is an incredible tool for businesses operating across borders. It also helps:

- Decrease currency exchange rate risks.

- Manage accounting compliance needs.

- Create and combine financial management reports for multiple currencies.

Acumatica Cloud ERP for Multicurrency Accounting

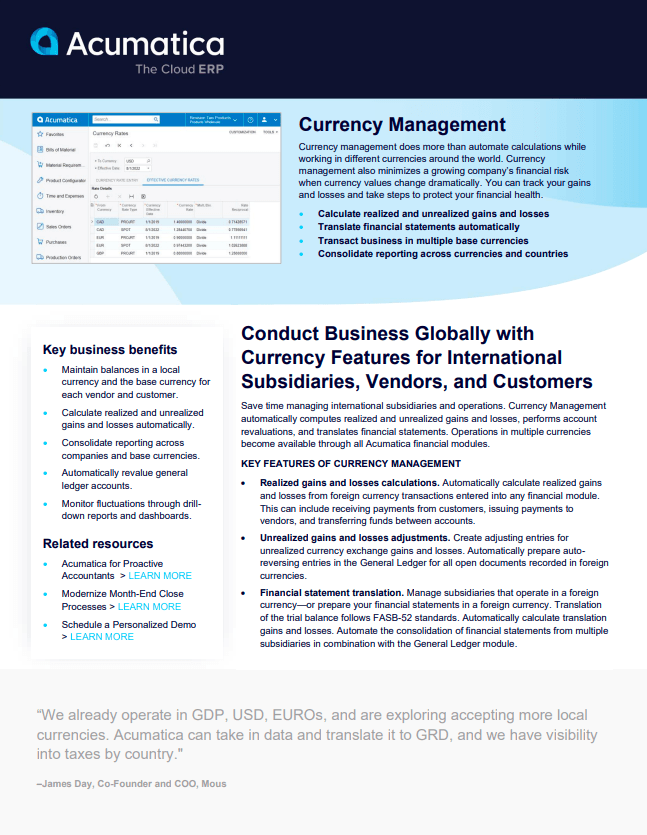

Acumatica is an award-winning cloud ERP (Enterprise Resource Planning) solution that offers small and midsized companies in every industry a comprehensive business management solution that equips them with the resources, tools, and support they need to thrive in today’s digital economy. In terms of multicurrency accounting, Acumatica’s Currency Management application delivers key multicurrency features, including:

- Revaluation of general ledger accounts.

- Unlimited currencies and rate types.

- Multiple base currencies.

- Configurable decimal precision.

- Automatic handling of rounding differences.

- Complete tracking of gains and losses.

- Currency rate lookup.

- Historical and auditing reports.

- Audit trails.

- Predefined list of currencies.

With Acumatica, companies can conduct business at home and abroad, confident that their currency management processes are no longer manual and time-consuming but automated and streamlined. Calculating realized and unrealized gains and losses, translating financial statements, consolidating reports across currencies and countries, and transacting business in multiple base currencies are possible in one, powerful multicurrency accounting system.

Download Currency Management Product Sheet

Conclusion

Multicurrency accounting allows international companies to manage and record their financial transactions regardless of which currency they use. To ensure that their multicurrency accounting practices are effortless and accurate, companies need a modern multicurrency accounting system, like Acumatica, which supplies foreign currency accounts, exchange rate management, automated revaluations, real-time reporting, and financial statement translation.

Says Acumatica customer Sean Reuben, Group Chief Financial Officer, Incubeta, “[Within Acumatica,] we’ve started to use Power BI and now have the ability to select and transform data from each currency and pull them into one dashboard. That’s brilliant.”

Learn more about Acumatica’s truly brilliant multicurrency accounting capabilities by contacting our team today. Together, we can overcome geographic boundaries and take your business where you want to go.