Because there are many Payroll Management Software options from which to choose, determining which one will fully meet a company’s industry-specific needs requires an assessment of each option’s features. Keep in mind that having a lot of features does not mean having the right features, so here are the key features companies should look for when selecting their software:

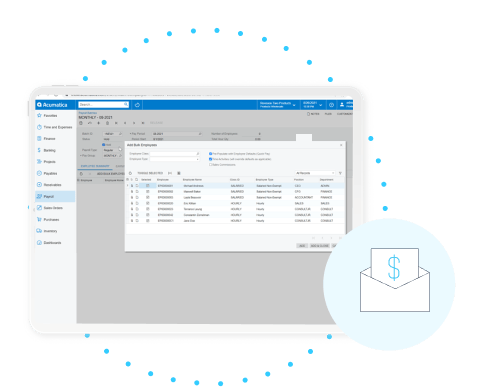

Wage and Benefits Management

Salary, wage, and benefit information should be accessible at any time and from anywhere through modern Payroll Management Software, allowing users to track hours, calculate payroll, make modifications, maintain documentation and more from a single dashboard.

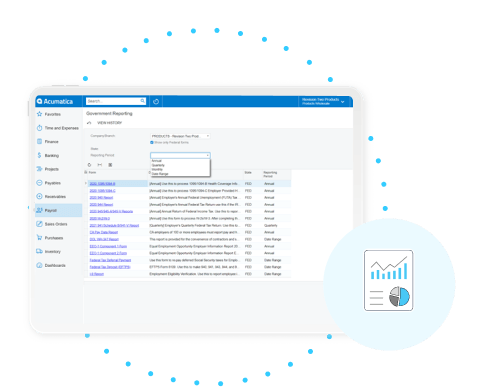

Tax Management

Varied federal, state, and local taxes, as well as international taxes, make compliance a complicated task, but ERP-based Payroll Management Software should simplify the process by automating the tax filing procedures and providing automatic tax rate updates.

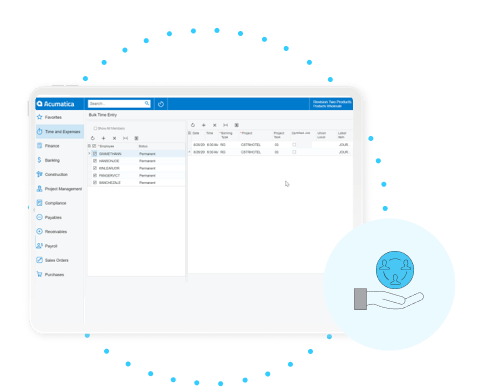

Operational Expenditure Management

In addition to payroll and tax management, Payroll Management Software should provide operational expenditure management. Operational expenditure is how much a business spends to maintain operations, including employee payments. Having this information in a centralized, easily accessed, and user-friendly database aids in keeping costs down and accuracy intact.

Reporting and Analytics

Reporting on and analyzing payroll data should be made easy by the right Payroll Management Software through inquiry screens and out-of-the-box reports. With this information, a company can make quick, strategic decisions that benefit the employees and the company.

Finally, make sure that whichever Payroll Management Software you choose is intuitive, reliable, and built on a future-proof platform, ensuring that it works for a company’s needs today and tomorrow.

“With Acumatica Payroll, processing is streamlined from start to finish, and we have access to real-time labor costs as part of job costing to make smart, strategic decisions.”

–Sam Fisher, Partner, Fisher Brother Exteriors