What is Accounting Automation?

Accounting automation software is software that automates repetitive but crucial accounting tasks, such as updating financial data, reconciling accounts, managing payroll, sending invoices, preparing taxes, and more. It’s a powerful tool for modern businesses that seek to improve their efficiency and accuracy.

Why Organizations Need Accounting Automation?

Using modern technology to automate workflows is quickly becoming a standard strategy for businesses operating in today’s digital economy. The accounting industry is part of this growing trend, but some accounting departments and firms have yet to embrace accounting automation.

This lack of accounting automation results in hours wasted on manually tracking assets/ expenditures, paying bills, billing clients, managing payroll, facilitating tax payments, and more. Instead of all this, accountants’ time, effort, and energy could be devoted to more creative, higher-value tasks.

With accounting automation software, you can enjoy:

- Faster task turnarounds – automate many of the manual tasks that accountants typically perform, such as data entry, invoice processing, and financial reporting. This can free up accountants to focus on more strategic activities, such as analysis and reporting. As a result, accounting tasks can be completed much faster, which can improve efficiency and productivity.

- Immediate data retrieval – store financial data in a central location, making it easy to access and retrieve. This can be helpful for making informed decisions about the business, such as budgeting, forecasting, and resource allocation. Additionally, immediate data retrieval can help to improve customer service by providing faster responses to queries about invoices or payments.

- Increased data accuracy and security – by reducing the risk of human error. This is because the automated accounting system is able to follow set rules and procedures when processing data. Additionally, accounting automation software can help to improve data security by encrypting data and restricting access to authorized users.

- Increased compliance – comply with financial regulations by ensuring that financial data is accurately and timely processed. This is important for businesses of all sizes, as non-compliance can result in fines or other penalties.

- Improved customer service – by providing faster and more accurate processing of invoices and payments. This can help to reduce customer frustration and improve customer loyalty.

- Improved decision-making – provide businesses with real-time financial data, which can be used to make better decisions about the business. This data can be used for budgeting, forecasting, resource allocation, and other important business decisions.

Here are some specific examples of how accounting automation can benefit different types of organizations:

- Small businesses: Small businesses can benefit from accounting automation by saving time and money on administrative tasks. This can free up time for business owners to focus on growing their businesses.

- Medium-sized businesses: Medium-sized businesses can benefit from accounting automation by improving efficiency and accuracy. This can help them to compete more effectively with larger businesses.

- Large businesses: Large businesses can benefit from accounting automation by streamlining processes and reducing risk. This can help them to improve profitability and compliance.

Your Accounting Teams and Automation

If your business falls into the “no accounting automation” category, you’re not alone. The McKinsey Global Study also reveals that 13% of respondents had no plans to automate their accounting workflows. But accounting automation offers benefits that may convince them (and you) to reconsider.

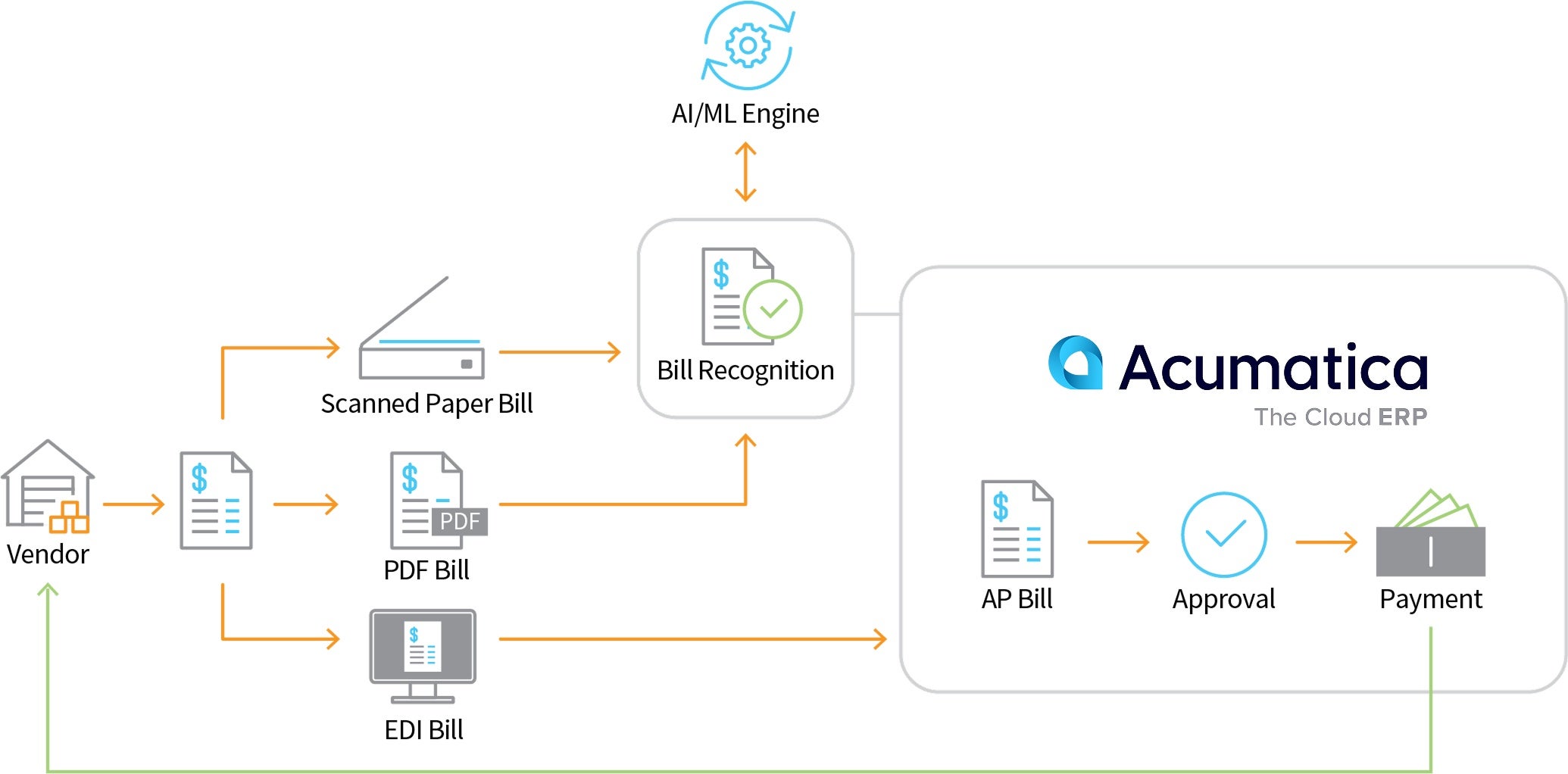

Leveraging the power of automation through Acumatica Cloud ERP and its integrated accounting automation software increases your team’s speed and accuracy. It also helps each team member optimize their time management, resulting in lower costs and faster task turnarounds. And implementing industry-specific software gives you valuable peace of mind; you can rest assured that the software provides enterprise-level data security along with greater control over—and accurate visibility into—all your financial and accounting processes.

Canada (English)

Canada (English)

Colombia

Colombia

Caribbean and Puerto Rico

Caribbean and Puerto Rico

Ecuador

Ecuador

India

India

Indonesia

Indonesia

Ireland

Ireland

Malaysia

Malaysia

Mexico

Mexico

Panama

Panama

Peru

Peru

Philippines

Philippines

Singapore

Singapore

South Africa

South Africa

Sri Lanka

Sri Lanka

Thailand

Thailand

United Kingdom

United Kingdom

United States

United States